Understand Term vs. Whole Life

When it comes to protecting your loved ones with life insurance, one of the first questions you’ll face is: Should I choose term or whole life insurance? Both types provide valuable protection, but they work in very different ways. Understanding the differences will help you choose the right option for your family and your financial goals.

What Is Term Life Insurance?

Term life insurance provides coverage for a set period of time — often 10, 20, or 30 years. If you pass away during that term, your beneficiaries receive the death benefit.

Key features:

Lower premiums – More affordable, especially for young families.

Temporary coverage – Ends when the term expires (unless renewed).

Straightforward protection – No cash value, just pure coverage.

Best for: People who want simple, budget-friendly protection during their working years — for example, covering a mortgage, income replacement, or raising children.

What Is Whole Life Insurance?

Whole life insurance is permanent coverage, meaning it lasts your entire lifetime as long as premiums are paid. In addition to a death benefit, it also builds cash value you can borrow against or use later in life.

Key features:

Lifelong coverage – No expiration date.

Cash value growth – Acts as a savings component within the policy.

Higher premiums – More expensive than term, but offers extra benefits.

Best for: People looking for lifetime protection and a way to build wealth or leave a financial legacy.

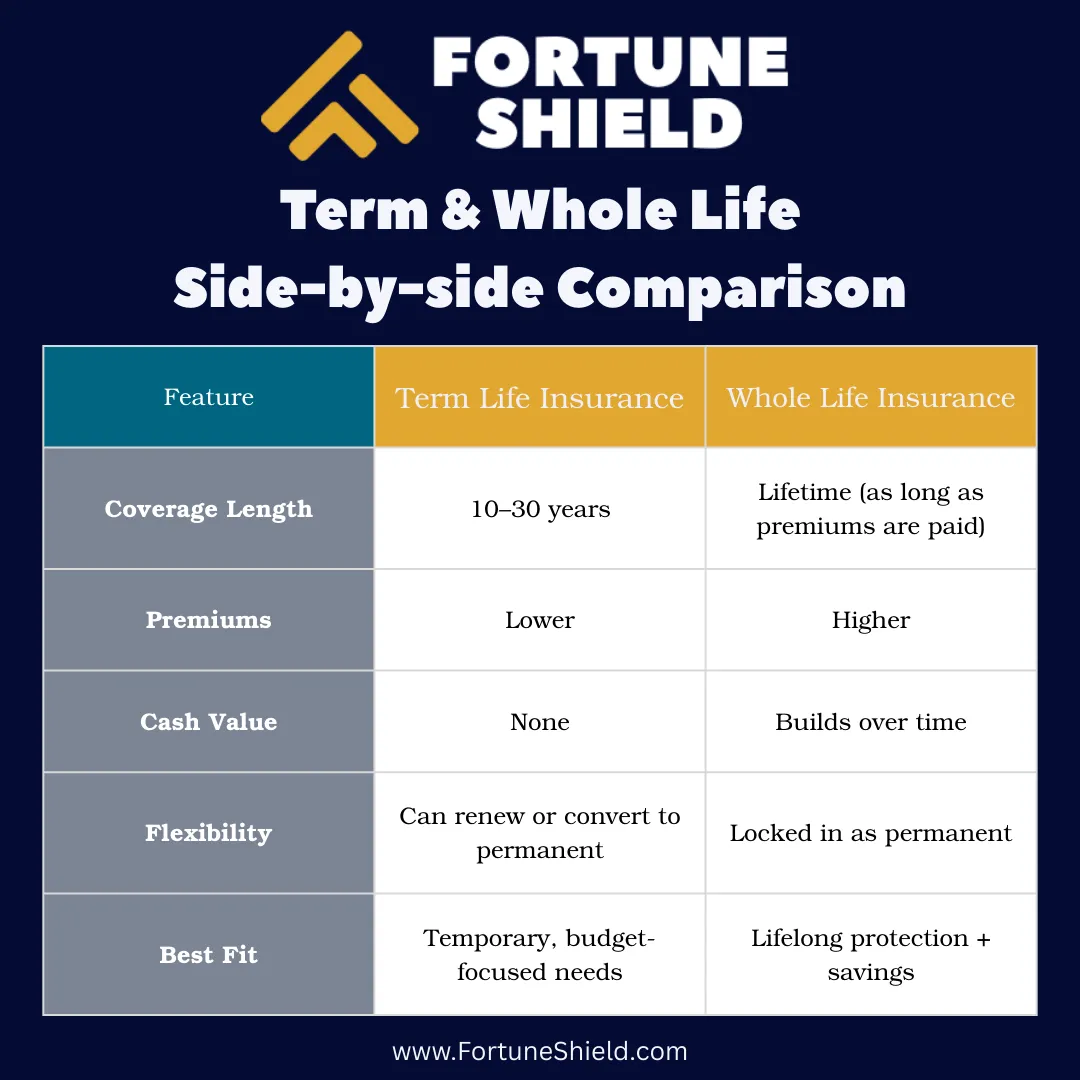

Side-by-Side Comparison

How to Decide

Choosing between term and whole life comes down to your goals and budget:

If you need affordable coverage while raising a family or paying off debt, term is often the best fit.

If you want permanent protection, plus a way to build tax-deferred cash value, whole life may be worth the higher cost.

Some families even combine both — starting with term for high-need years and layering whole life for long-term security.

Next Steps

Life insurance is a personal decision, and there’s no “one-size-fits-all” answer. At Fortune Shield, we’ll walk you through your options and tailor coverage that works for your family, your budget, and your future goals.

Request a Free Life Insurance Quote →

⚖️ Compliance Note

Fortune Shield is a licensed independent insurance agency. Products and availability vary by state and carrier. This content is for educational purposes only and should not be taken as financial or legal advice.